Within the digital asset landscape, security is a critical concern. It’s probably fair to say that security failings within the crypto sphere have taken center stage within the realm of media discourse.

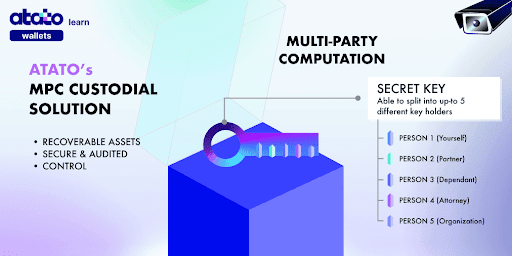

That’s why it’s becoming increasingly evident that ensuring robust security measures is not just a choice, but an imperative that fuels the industry’s growth and broader adoption as trust is built through the safeguarding of digital assets. Atato Custody addresses these pressing security concerns by offering an unparalleled MPC-based wallet solution coupled with advanced custody services as platform, tailored specifically for web3 businesses.

In this article, we’ll break down the MPC technology behind MPC wallets and compare them to the standards already out there, starting with the emergence of MPC wallets as a new security standard for the protection of digital assets.

What Is MPC Technology for Blockchain?

At its core, Multi-Party Computation (MPC) technology is a cryptographic technique that enables a collaborative computation process involving multiple parties without exposing individual inputs. This technology holds substantial potential for blockchain applications, particularly in securing digital assets under custody.

The essence of MPC lies in its ingenious design, empowering multiple entities to collaboratively engage in computation without the need to unveil their individual inputs. This remarkable feat is achieved through a symphony of cryptographic techniques that orchestrate secure collaborative computation. In the context of blockchain, where data integrity and security are paramount, MPC’s emergence is akin to a digital sentinel, steadfastly guarding against threats and vulnerabilities.

Industries spanning finance, healthcare, and supply chains find resonance in MPC’s versatility. The realm of supply chains offers a vivid canvas for MPC’s application. Imagine a global supply chain, rife with diverse stakeholders contributing crucial information. Through MPC, these entities can participate in secure data contributions, ensuring product authenticity while upholding proprietary data. The result is a seamless verification process fortified by data integrity—a hallmark of MPC’s influence.

Why are MPC Wallets Paramount for Digital Asset Security?

The surge of cryptocurrencies has brought about a transformative blend of innovation and the pressing need for safeguarding digital assets. Amid this dynamic backdrop, Multi-Party Computation (MPC) wallets have emerged as a promising antidote to the intricate security challenges. The integration of MPC technology ushers in a novel methodology for ensuring the security of digital asset management, adeptly neutralizing potential hazards associated with conventional private key storage techniques and pitfalls.

Leveraging the prowess of MPC technology, investors can now have the assurance in the sanctuary of their digital possessions. This assurance extends its embrace even in the face of ceaselessly evolving threats perpetuated by hackers and other malevolent actors.

MPC technology finds its purpose in fortifying the security of private keys—the cryptographic linchpins that facilitate access and seamless transactions within the realm of cryptocurrencies. Historically ensconced within a solitary repository, private keys bore the vulnerability of theft, loss, or catastrophic demise. An MPC wallet divides the conventional private key into multiple distinct shares, each allocated to different stakeholders.

When a transaction necessitates cryptographic signing, these stakeholders collectively contribute to generating the transaction signature. Notably, the full private key is never reconstructed during this process, enhancing security throughout the transaction lifecycle.

Even in the unfortunate event of a breach, the resiliency of MPC technology remains steadfast. The onus of bypassing its defense mechanisms requires a synchronized compromise of all key fragments scattered across various locations. The complexity inherent in this endeavor erects an imposing barricade against unauthorized access attempts.

MPC Wallets vs Traditional Wallets

MPC Wallet vs Hot-Cold & Hardware Wallets

MPC wallets shift from traditional solutions like hot-cold and hardware wallets. Unlike conventional methods where private keys stay whole, MPC wallets split the private key into secure shares, reducing unauthorized access risk.

In cryptocurrency, wallet evolution highlights distinct security paradigms. “Old” wallets lack modern security, while “hot” wallets sacrifice security for convenience. “Hardware” wallets, like Ledger, bring offline protection.

However, risks remain in holding private keys, whether in hot wallets or hardware devices. Hacking or physical possession threatens funds.

Multi-Party Computation (MPC) technology reshapes digital wallet security. MPC wallets split private keys across locations, resisting compromise. Even if one part is breached, the full key is safe.

MPC wallets allows company-level security, sharing risk and control. This nullifies single point of failure threats, enhancing security beyond traditional methods. The evolution from old to hot to hardware wallets underscores security’s importance, with MPC technology as the top of innovation, redefining wallet security through collaborative control.

MPC Wallet vs Multisig Wallets

Comparing MPC wallets with multisig wallets highlights their unique benefits. Both distribute control, but MPC splits the private key itself, strengthening security by removing single points of failure.

The shift from MultiSig to Threshold Signatures is crucial for secure cryptocurrency approvals. SBI Holdings and Binance‘s CEO prefer Threshold Signatures, predicting they’ll revolutionize custodian services. About twenty providers plan Threshold Signature wallets, supported by five reasons over MultiSig:

- Universal Integration vs. Customization: Threshold Signatures seamlessly integrate as standard on-chain signatures, unlike MultiSig’s varied signatures.

- Smaller, Cheaper Transactions: Threshold Signatures’ consistent single signature reduces transaction sizes, unlike MultiSig’s multiple signatures, inflating fees.

- Enhanced Privacy and Security: Threshold Signatures hide approver details, while MultiSig exposes signatures and security policies.

- Simple Key Share Refresh: Threshold Signatures refresh key shares with computation, unlike MultiSig’s complex on-chain process.

- Operational Flexibility: Off-chain Threshold Signatures adapt better to security models, regulations, and market demands.

atato Wallet | MPC Wallet – Bank Grade for Crypto Institutions

Among the digital asset security solutions, the atato Wallet stands as a pioneer in MPC wallets. It introduces a meticulously tailored suite of features in a custodial wallet that align with security demands of today’s institutions holding digital assets. Central to its design is the seamless infusion of bank-grade security measures, a foundational element that distinctly sets the atato Custody MPC Wallet apart. Below, you can check details about the features of this MPC wallet:

Security:

Atato Custody is operating as a licensed and audited crypto custodian, atato Custody aligns with Singapore’s regulatory framework. This alignment offers clients the assurance that their assets are protected by a trusted, audited and licensed crypto custodian. By adhering to regulatory mandates, atato Custody exemplifies transparency and accountability in its operations, further enhancing client trust and confidence.

Compliance:

Atato Custody remains steadfast in its commitment to stringent crypto custodian regulations. Operating as a licensed and audited crypto custodian, Atato aligns with Singapore’s regulatory framework. This alignment offers clients the assurance that their assets are protected by a trusted and compliant crypto custodian. By adhering to regulatory mandates, Atato Custody exemplifies transparency and accountability in its operations, further enhancing client trust and confidence.

Convenience:

Atato Custody extends compatibility to encompass Bitcoin, EVM chains, and layer 2 blockchain solutions. This versatile support enables clients to securely store and manage a diverse array of cryptocurrencies within a unified custodial platform. Whether navigating the Ethereum network or engaging with various layer 2 scaling solutions like Optimism or Arbitrum, Atato Custody presents a comprehensive solution for overseeing digital assets across a spectrum of blockchain ecosystems.

Accessibility:

Elevating convenience and accessibility, atato Custody’s custodial MPC wallet offers an innovative approach. Users can directly access their wallets through the mobile app while utilizing their mobile devices as approvers. This seamless integration creates a user-friendly experience, allowing individuals to effortlessly monitor token balances and access wallet functionalities on the go.

Innovation:

The custodial wallet by atato Custody is just one facet of its dedication to pushing the boundaries of crypto custody. With an unwavering focus on innovation, atato Custody continuously explores novel solutions to meet the evolving needs of the crypto community.

BOOK A DEMO OF ATATO CUSTODY APP TODAY

Experience Our Multiple Wallet Connect in Action

Conclusion

Multi-Party Computation (MPC) wallets mark not only a new solution but also the dawn of a transformative era in digital assets security. The imperative to counter risks, fortify privacy, and collaborate securely becomes essential for web3 businesses. MPC technology emerges as addressing these challenges head-on and paving the way for enhanced security.

Recapping the unique features of Atato’s MPC wallet and custody platform, the Bring Your Own Chain (BYOC) approach offers a level of control and transparency unmatched in the industry. This empowers users to seamlessly integrate their preferred custodian, bridging the gap between individual preferences and institutional-grade security.